Local News

A three-story mixed use development with 196 apartments and 79,200 feet of existing commercial space near the intersection of Shea Boulevard and 70th Street took a step forward toward becoming a …

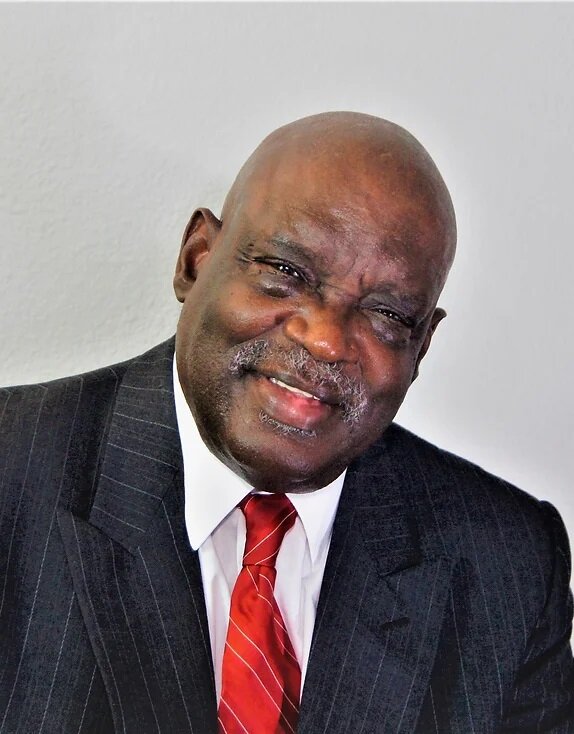

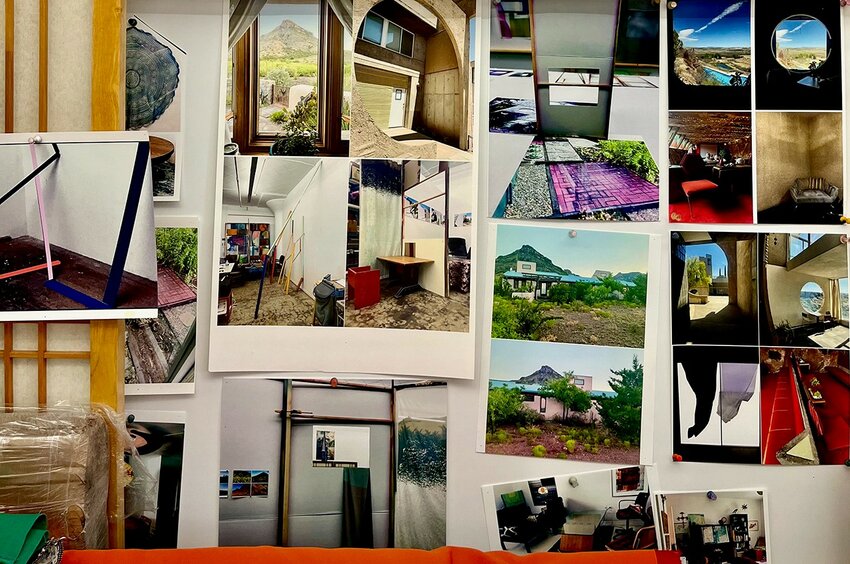

Featured Artist

If someone told William “Doc” Jones 50 years ago that his career would span the globe, playing jazz alongside artists like Otis Williams and Aretha Franklin he would have laughed, …

Education

Desert Mountain High School made it to No. 20 on U.S. News and World Report’s annual best public high schools list for Arizona. The school was ranked 1,283 nationally.

The publication …

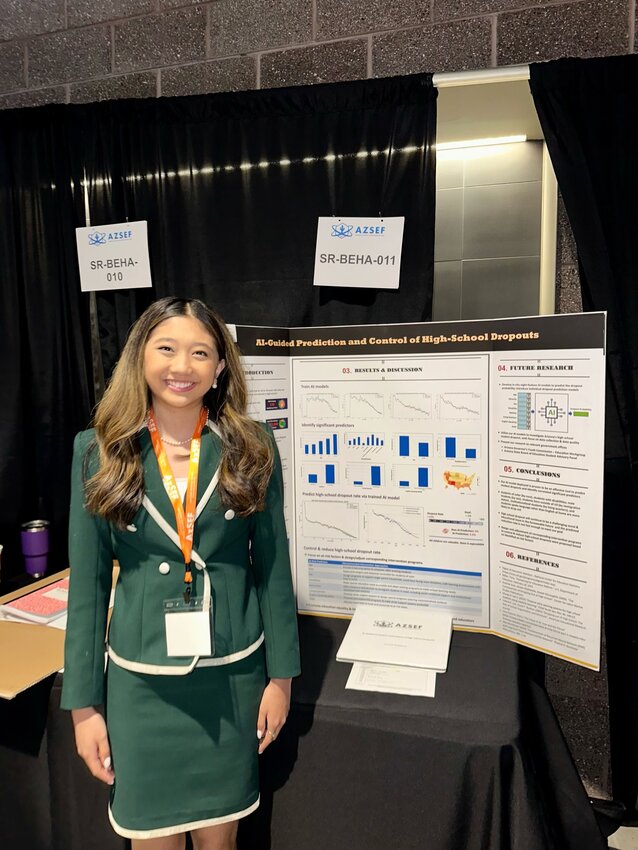

Junior Achievement

Sophia Lin was recognized as a Junior Achievement 18 Under 18 award winner of Thursday, April 18.

The BASIS Scottsdale junior is a cofounder of iReach, a youth led nonprofit education service, …

Dance Concert

The Scottsdale Community College Dance Program presents Kinetic Connections, a dance concert performed by SCC’s two resident companies and guests, on Friday, May 3 and Saturday, May 4. The show …