Local News

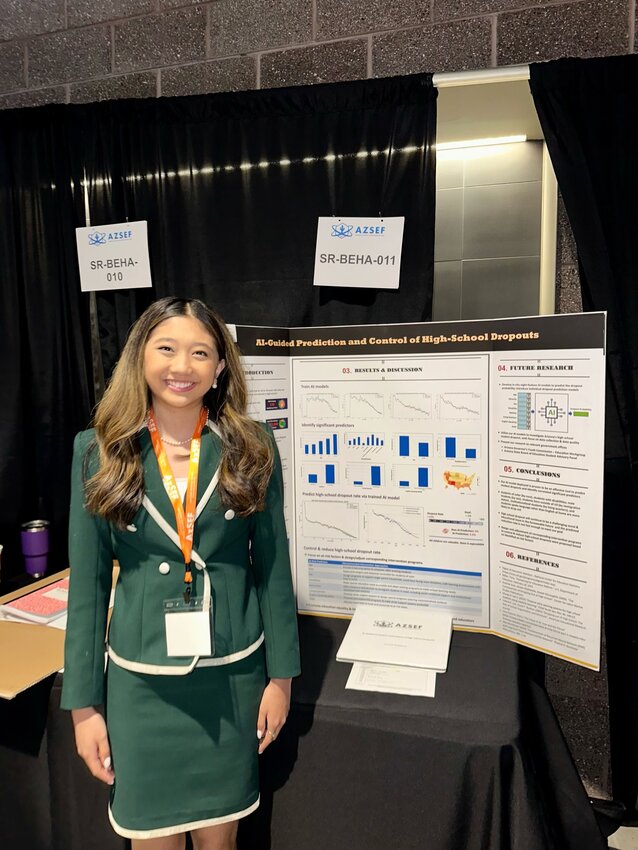

Junior Achievement

Sophia Lin was recognized as a Junior Achievement 18 Under 18 award winner of Thursday, April 18.

The BASIS Scottsdale junior is a cofounder of iReach, a youth led nonprofit education service, …

Dance Concert

The Scottsdale Community College Dance Program presents Kinetic Connections, a dance concert performed by SCC’s two resident companies and guests, on Friday, May 3 and Saturday, May 4. The show …

Government

Republicans from Mesa and Scottsdale were among those who blasted their colleagues and Democrats on Wednesday during what amounted to the first vote to repeal Arizona’s 1864 law that bans …

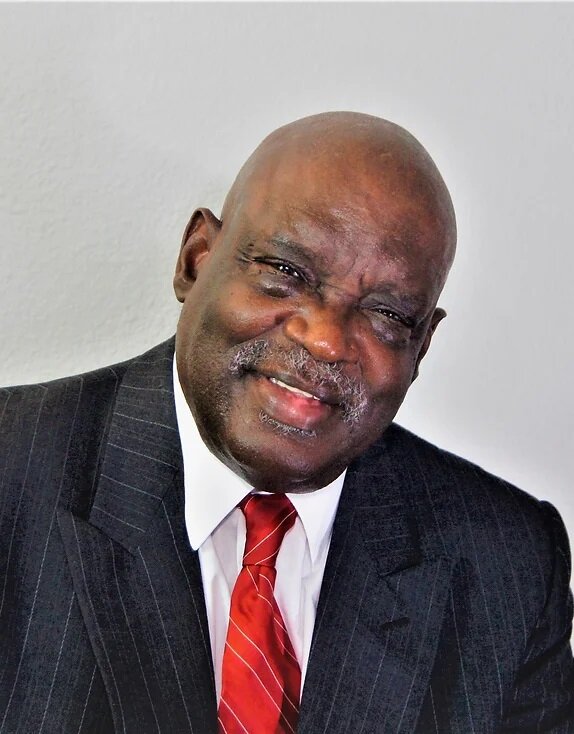

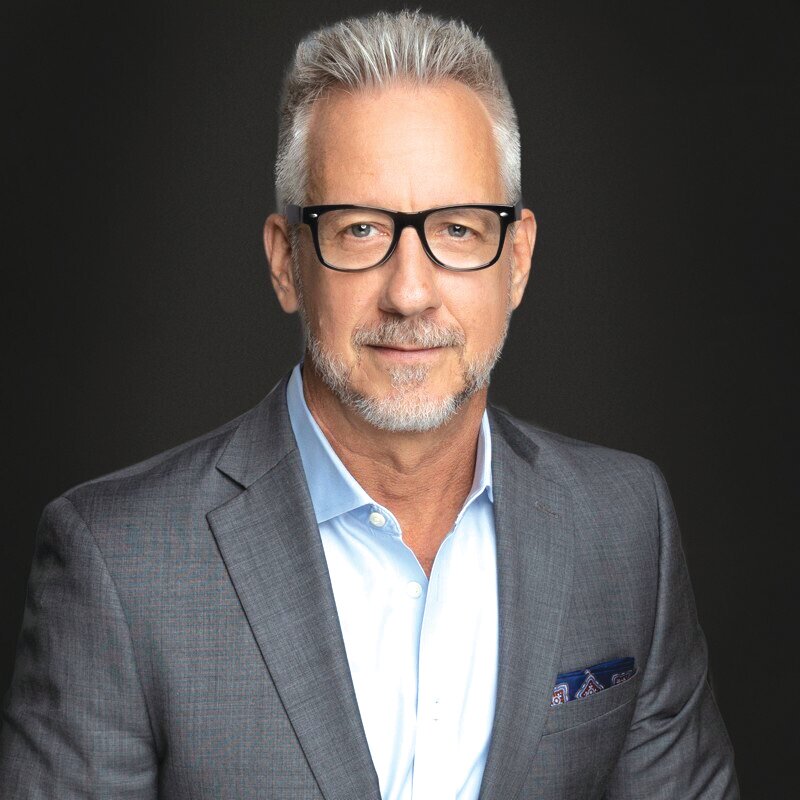

Staffing

Lessen, a tech-enabled, end-to-end solution for real estate property services, announced the expansion of its leadership team with the addition of Kevin Owens as executive vice president, …

Sustainability

Scottsdale’s draft Community Sustainability Plan is open for public feedback until Tuesday, April 30 and is scheduled for consideration and adoption by the city council on May 21.

Designed …