Opinion

American wagyu is becoming known around the world as one of the top styles of beef. Due to its amazing marbling of fat, tenderness and unique flavor American wagyu beef is demanded by chefs all over …

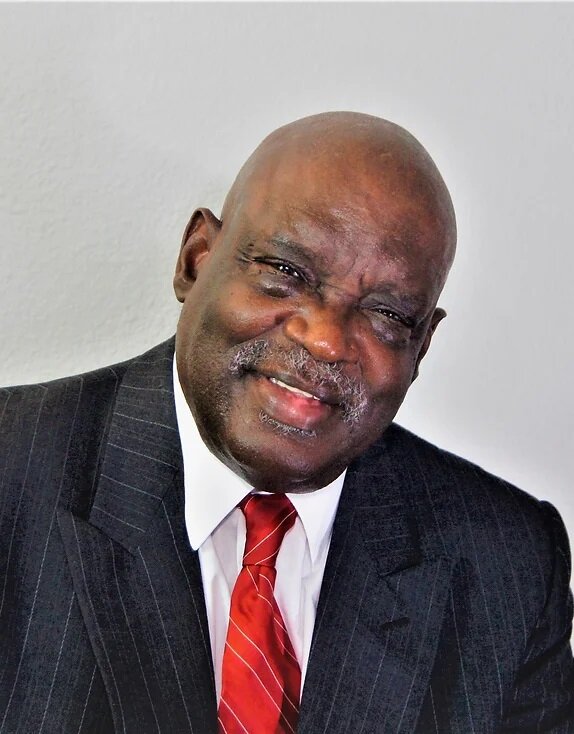

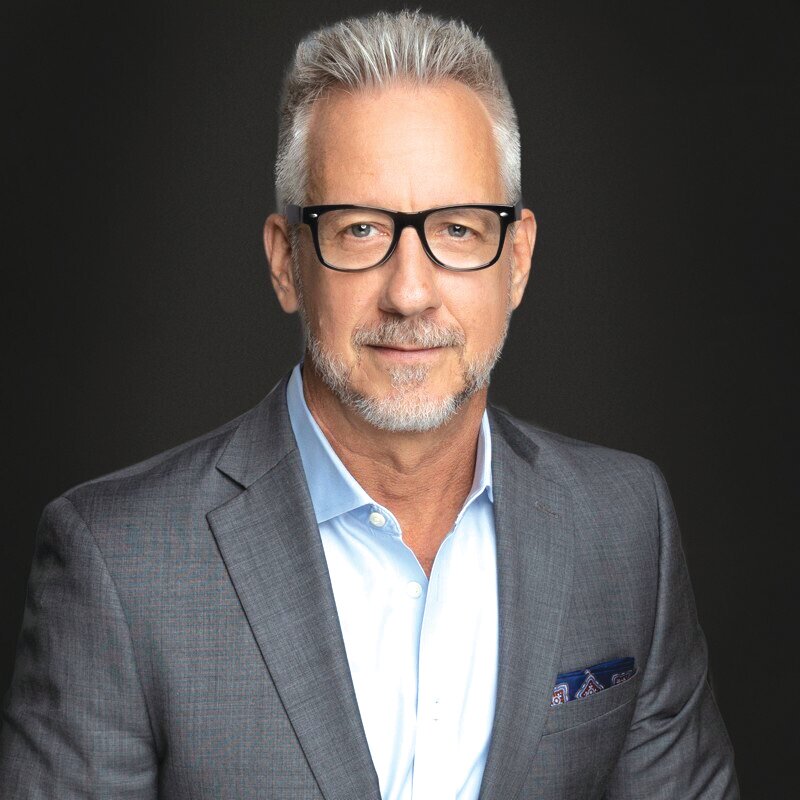

Staffing

Lessen, a tech-enabled, end-to-end solution for real estate property services, announced the expansion of its leadership team with the addition of Kevin Owens as executive vice president, …

Sustainability

Scottsdale’s draft Community Sustainability Plan is open for public feedback until Tuesday, April 30 and is scheduled for consideration and adoption by the city council on May 21.

Designed …

Restaurant

With this year’s Tax Day around the corner, Grimaldi’s Pizzeria is treating customers to a 1040 tax form-related deal (no tax return included). With all seven Valley locations …

Volunteering

Scottsdale Mayor David Ortega has proclaimed April 21-27 as Scottsdale Volunteer Appreciation Week, recognizing the thousands of citizen volunteers who make a difference in the city every day.

…

Anniversary

Storybook Entertainment, the full-time entertainment company that has brought joy to more than 3,000 birthday parties and numerous public events, is celebrating its 10-year anniversary on Saturday, …

Oakley’s Oath

Julie Kessler continues to advocate for the importance of taking extra precautions to protect the safety of children and pets during construction and home repair.

Kessler’s dog, Oakley, …

Deans List

Scottsdale resident Abby McDonald was named to the 2023 fall semester dean’s list at Simmons University in Boston.

To qualify for dean’s list status, undergraduate students must …

Read more