Opinion

Another reader expresses her concern about the Independent’s civility checklist for opinions, arguing that it can constrain free speech.

I respectfully disagree. There are plenty of …

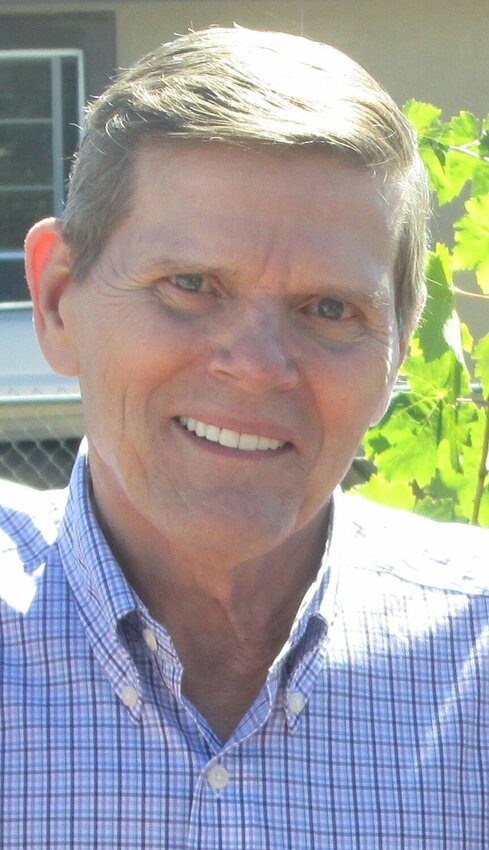

Opinion

What’s the secret to growing, thriving, healthy community? A pipeline of forward-looking leaders who are motivated to unite our community, preserve what makes us unique and innovate to keep us …

Opinion

Over the past weeks, we have observed protests on college campuses across the nation. These events, which I believe are orchestrated and funded by external radical activists, have exploited the …

Nonprofits

The City of Scottsdale is now taking donations for its beat the heat program.

You can bring summer relief to low-income, homebound and isolated seniors by donating to the Beat the Heat outreach …

Nonprofits

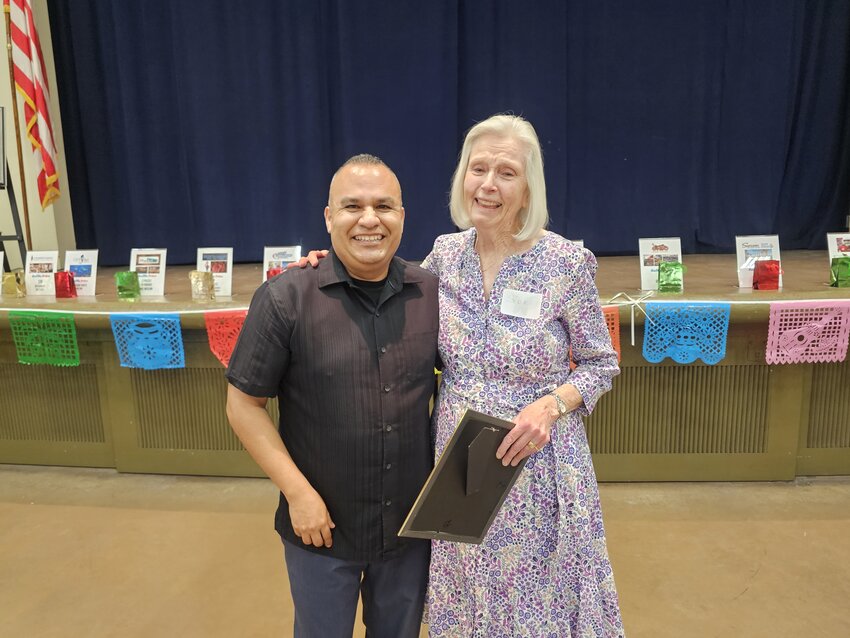

Duet: Partners In Health & Aging had a Volunteer Appreciation Event on Sunday, April 14 at Church of Beatitudes in Phoenix with over 80 volunteers in attendance.

Each year, the celebration …

Volunteering

Russ Lyon Sotheby’s International Realty and the RL Foundation, the non-profit charitable and service work branch of Russ Lyon Sotheby’s International Realty, recently returned to Agua …

Writers

Betty Webb will be the speaker at the May 29 meeting of the Scottsdale Society of Women Writers.

Former journalist, Betty Web is the author of twenty mysteries: the bestselling Lena Jones …

Nonprofit

Hunkapi Programs, an equine therapy farm located in the heart of Scottsdale, participated in The Price is Right game show in February, resulting in a volunteer winning the organization over $18,000.

…

Read more