Opinion

Everyone wants to stop violence today, but no one knows how. Some think we will be able to find the answer with Artificial Intelligence (A.I.) because it has amazing capacities that our scientists …

Things to Do

Museum of Illusions Scottsdale is offering a slew of deals and experiences for visitors of all ages including promos for students, teachers, and mothers in May.

Every day in May, students can …

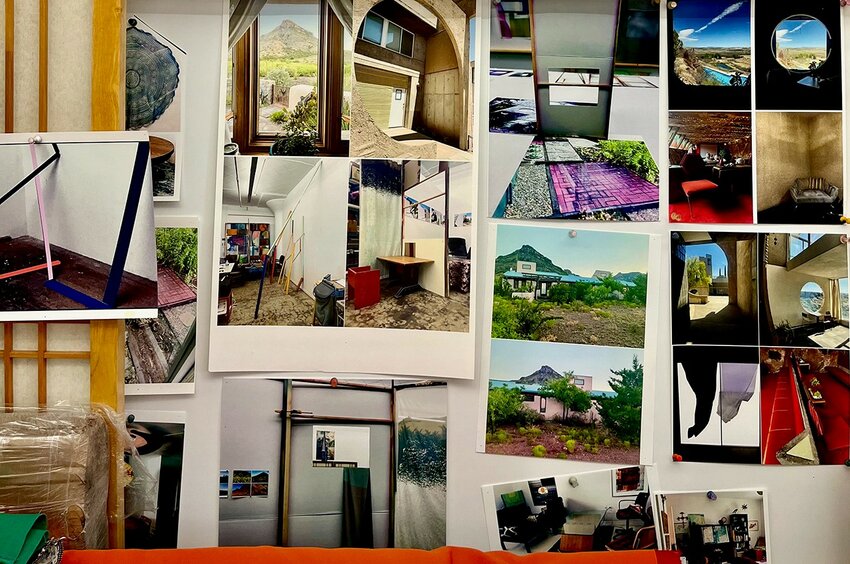

Honors

The Home Builders Association of Central Arizona announced the winners of the 38th annual Major Achievements in Merchandising Excellence Awards at a ceremony held April 6, 2024, at the JW Marriott …

Night Out

The Valley of the Sun Jewish Community Center in Scottsdale will host an exciting and fun-filled night of indoor “glamping” for children in grades K-8 Saturday, April 20, from 5 p.m. to 8 …

Entrepreneur

Ever been lying in bed worrying about the day’s medical appointment? What did the doctor say about the diagnosis? How much was the bill?

You’ll call first thing in the morning …

Nonprofit

April 24 is Stop Food Waste Day and local nonprofit, Waste Not, is teaming up with Valley restaurant, Birdcall, to help raise awareness.

Arizona is known as the worst offender for food waste in …

SUSD

The Scottsdale Math & Science Academy (SMSA) celebrated its students’ recent projects and achievements at the annual STEAM showcase on Saturday, April 13.

The SMSA is a specialized …

Trever Wilde, CEO and investment advisor for Scottsdale’s Wilde Wealth Management Group, was named the No. 2 overall advisor in Arizona. (Wilde Wealth Management Group)

Forbes names …

Read more