Opinion

As a former member of the Scottsdale City Council, I know first-hand that our city has a burgeoning tourism, hospitality, entertainment and nightlife industry. Bars, restaurants, nightclubs, sporting …

Football

Scottsdale’s Cooper Perry, one of Arizona’s top-ranked high school football prospects, committed to the University of Oregon on Wednesday, April 10.

Perry is a junior at Notre Dame …

Opinion

Former Republican senator and physician Tom Patterson makes some good points in his letter. However, his true colors are revealed when he declares that going green will drive us into poverty based on …

Subscriber Exclusive

Surprise library officials are hoping to stay relevant in the digital age of books on phones with apps that drive reading.

election

Candidates officially filed their petitions April 1 to run in the 2024 primary election for Arizona State House of Representatives District 4.

District 4 is entirely in Maricopa County, …

Scottsdale’s property tax rate should go down about 6% next year, according to the fiscal year 2024-25 budget proposed by city staff.

The city staff has proposed a $2.29 billion budget for …

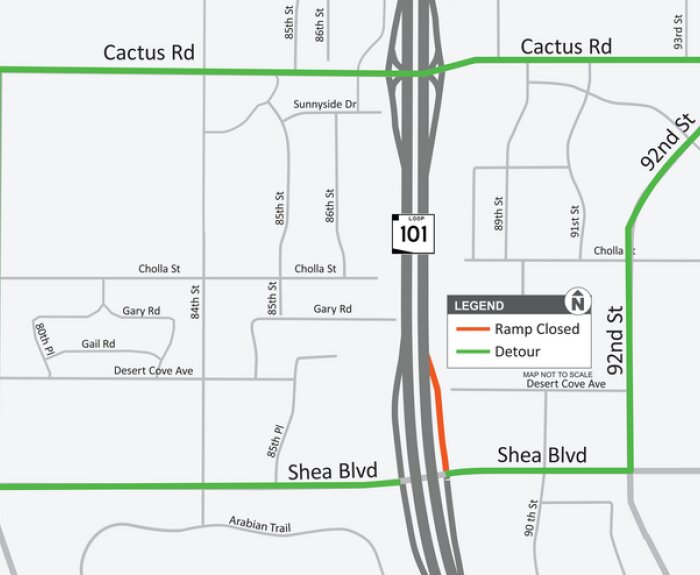

TRANSPORTATION

The northbound Loop 101 on-ramp at Shea Boulevard in Scottsdale is scheduled to be closed for about 60 days, starting Monday, April 15.

The closure is necessary for reconstruction work as part …

election

Candidates officially filed their petitions April 1 to run in the 2024 primary election for Arizona State House of Representatives District 4.

District 4 is entirely in Maricopa County, …

Read more