Anniversary

Storybook Entertainment, the full-time entertainment company that has brought joy to more than 3,000 birthday parties and numerous public events, is celebrating its 10-year anniversary on Saturday, …

Oakley’s Oath

Julie Kessler continues to advocate for the importance of taking extra precautions to protect the safety of children and pets during construction and home repair.

Kessler’s dog, Oakley, …

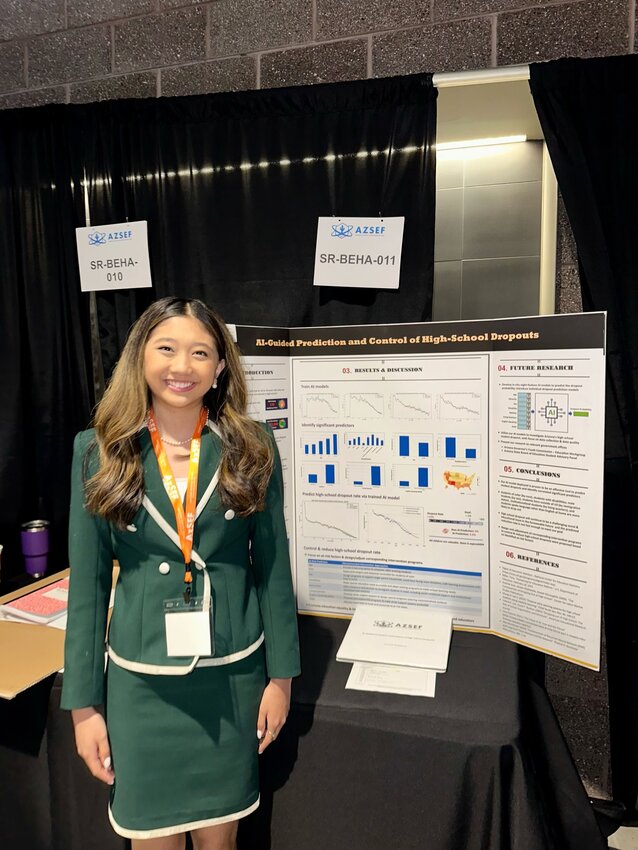

Deans List

Scottsdale resident Abby McDonald was named to the 2023 fall semester dean’s list at Simmons University in Boston.

To qualify for dean’s list status, undergraduate students must …

Live Music

The Ravenscroft is hosting its first two concerts in May in support of a Peoria-based non-profit food assistance program for at-risk high school students facing food and housing insecurity.

…

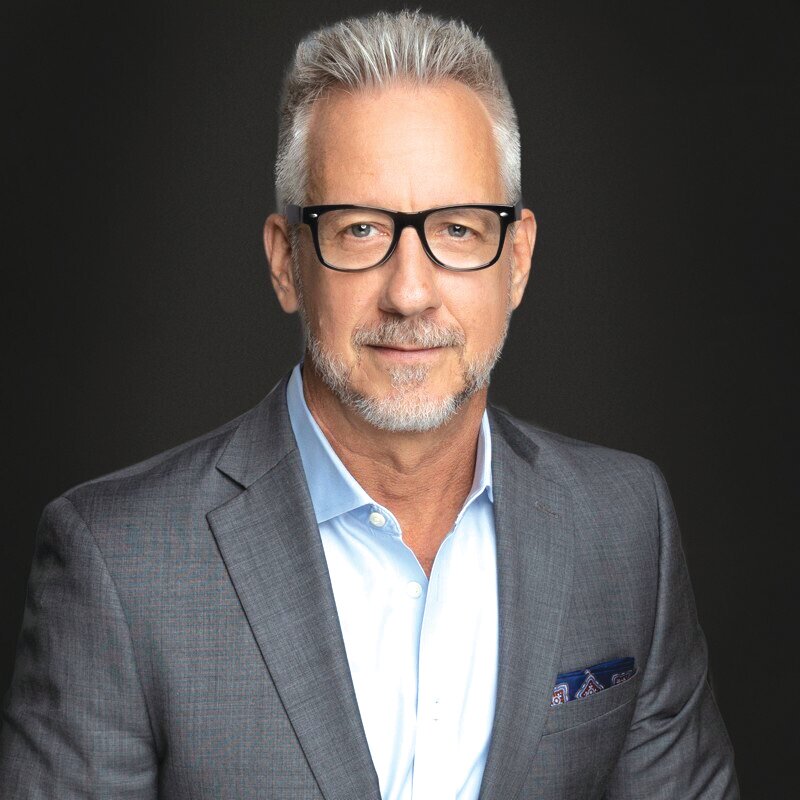

Home Sales

Scottsdale-based 72SOLD is poised to help hundreds of first-time home buyers across the state of Arizona with the launch of its zero commission initiative, the “72SOLD Companion Buyer …

Things to Do

There are many unique pieces that tell a story at the Native Art Market in Scottsdale from paintings, ceramics and other art, where consumers can purchase authentic handcrafted Native items directly …

Grand Opening

The Vuori store is opening a location at the Scottsdale Fashion Square. It is part of the Macerich portfolio of properties.

The 4,850-square-foot store, located on the lower level of the …

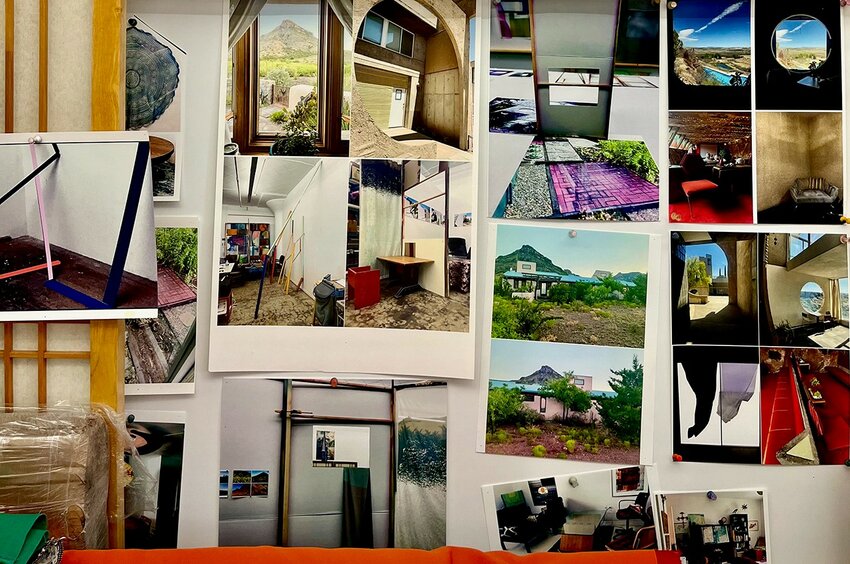

Interior designer Anita Lang, founder of IMI Design Studio in Scottsdale, has been transforming, creating and crafting interior spaces in Arizona and around the country for nearly 28 years.

…

Read more