Live Music

The Ravenscroft is hosting its first two concerts in May in support of a Peoria-based non-profit food assistance program for at-risk high school students facing food and housing insecurity.

…

Opinion

Most of us have come to the realization that Scottsdale is nothing more than an overpriced mecca for the wealthy. Everything has a dollar sign attached.

Scottsdale’s middle name is …

Home Sales

Scottsdale-based 72SOLD is poised to help hundreds of first-time home buyers across the state of Arizona with the launch of its zero commission initiative, the “72SOLD Companion Buyer …

Things to Do

There are many unique pieces that tell a story at the Native Art Market in Scottsdale from paintings, ceramics and other art, where consumers can purchase authentic handcrafted Native items directly …

Grand Opening

The Vuori store is opening a location at the Scottsdale Fashion Square. It is part of the Macerich portfolio of properties.

The 4,850-square-foot store, located on the lower level of the …

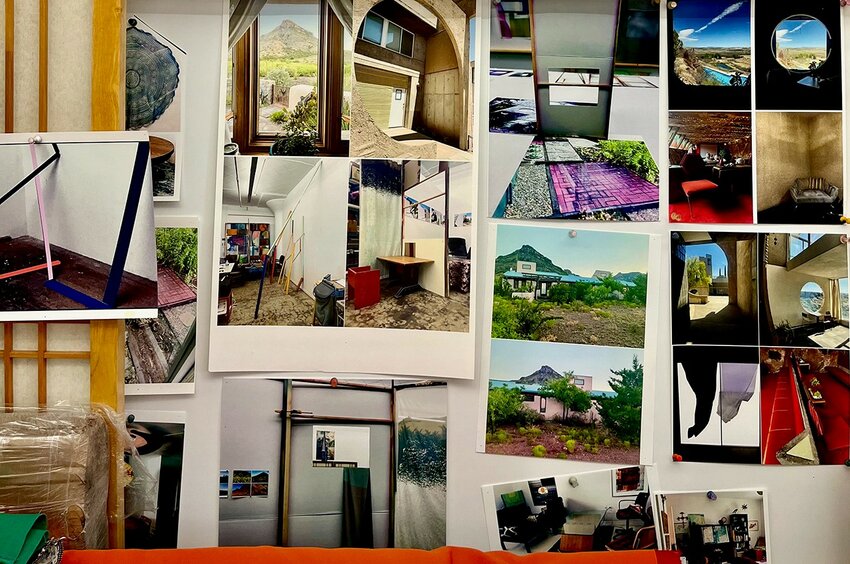

Interior designer Anita Lang, founder of IMI Design Studio in Scottsdale, has been transforming, creating and crafting interior spaces in Arizona and around the country for nearly 28 years.

…

Scottsdale’s Equality Health Foundation, the philanthropic partner of Equality Health, an organization dedicated to advancing health equity and improving well-being access for under served …

Health Care

Michael Reagin will join Banner Health’s senior leadership team in June, in the newly created role of executive vice president, chief technology officer.

Reagin will be responsible for IT, …

Read more